For the majority potential housebuyers, which have a great turnkey household which is willing to move into quickly was the only way to wade. But not, more and more buyers would like to get a whole lot more family due to their money while also opening the opportunity to tailor a property on the particular style.

What’s an FHA 203(k) Loan?

A keen FHA 203(k) mortgage allows borrowers to mix the price of to acquire a home that really needs home improvements with additional currency to cover the remodel.

That it plan works for the lender as well as the debtor, because it brings a cheaper solution which have finest terminology having the house visitors if you are giving loan providers the additional safeguards of one’s FHA support the loan.

Brand of 203(k) Finance

Limited loans have less rigid standards plus possess their disadvantages. Which have a small financing, you can use to $thirty five,000 for the upgrade. not, this money is perhaps not useable to possess major structural solutions.

A fundamental mortgage opens up extra cash plus has its constraints. Simple finance enjoys a minimum quantity of $5,100000. Rather than limited funds, you can utilize a simple financing to possess structural transform and you may updates.

Yet not, you must hire an effective HUD consultant to keep track of the fresh renovations to help you guarantee all the FHA performance and you will architectural requirements try came across.

Investment Eligibility

Such projects become first epidermis replacements otherwise enhancements. Enhancements were incorporating otherwise setting-up floors, establishing gutters and you can downspouts, enhancing the sewer otherwise plumbing work, and you can landscape improvement.

Way more inside tactics also are eligible for these FHA finance. Such projects become, but are not limited to help you, setting up an effective septic program, substitution roofing, and you may making improvements to your household one increase its total times efficiency.

It is critical to remember that these types of fund help target a whole lot more clicking issues, like structural problems that show prospective health and safety danger. You can utilize your own FHA 203(k) mortgage to help make the home offered to individuals with disabilities.

Debtor Certification

Also property standards, individuals must see individual certificates for FHA 203(k) financing acceptance. Similar to a vintage FHA financing, consumers must show he is financially capable of meeting monthly obligations towards the financing.

Having an effective FHA 203(k) financing, consumers should have a minimum credit rating from 500. not, loan providers may need a top credit rating when the other places out-of your application try weak.

Individuals with credit scores below 580 will have to set a great 10% down payment to help you be considered. While struggling to boost this type of fund, state down payment guidelines could be offered.

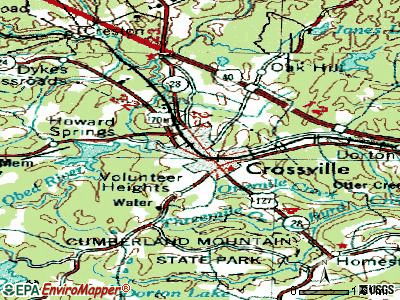

The amount of the borrowed funds is capped on a great limit, according to county where the home is found. For the majority areas, financing quantity can vary up to around $800,100000, whenever you are other counties can get maximum out at $350,000. The bank is direct what specific maximum can be found.

You could sign up for an FHA 203 k mortgage any kind of time FHA recognized bank. Once you meet with a loan provider, make an effort to the desired paperwork to exhibit which you meet up with the minimal conditions. These include shell out stubs, W2s, and you will bank comments.

Positives and you may Downsides from 203 (K) Money

Well-known benefit of this FHA financing program is how obtainable it generates the newest loans to those without much financial information otherwise that have terrible early in the day borrowing histories. Rates of interest also are usually lower than you could find that have more conventional financing issues with the same certification.

Amazingly, the loan money can help cover mortgage payments even though you remodel our 2400 dollar loans in Grand Bay AL home should your design is regarded as uninhabitable.

New downside on the FHA financing system is you usually have the additional expense from a good HUD representative if for example the home improvements are extensive.

You simply can’t utilize the currency having an investment property, similar to traditional FHA money. A last drawback would be the fact FHA finance wanted home loan insurance coverage. Build make sure you tend to be these types of in your commission calculations.

Add Comment

Only active ALBATROSS Racing Club members can post comments