Once you know you might pay off the card before interest rates beginning to add on into the roofing can cost you (particular credit cards give a basic appeal-100 % free period which can history per year or stretched for these that have higher credit scores), then you should go for it.

The convenience of bank card explore, and therefore cannot involve a loan application process, is attractive to some home owners, but there are even benefits and you will rewards (instance airline kilometers and you can cashback coupons) offered by certain charge card lenders that will be also attractive, specifically towards the a cost because hefty while the an alternative roof.

Personal bank loan

An unsecured loan for roof replacement costs is amongst the well-known types of purchasing your panels, primarily because the eye rates are very lowest. Extremely lenders usually set-up a monthly payment bundle that fits the minimum you could pay over a-flat time frame, but as in very financing activities, using it off immediately is more financially prudent.

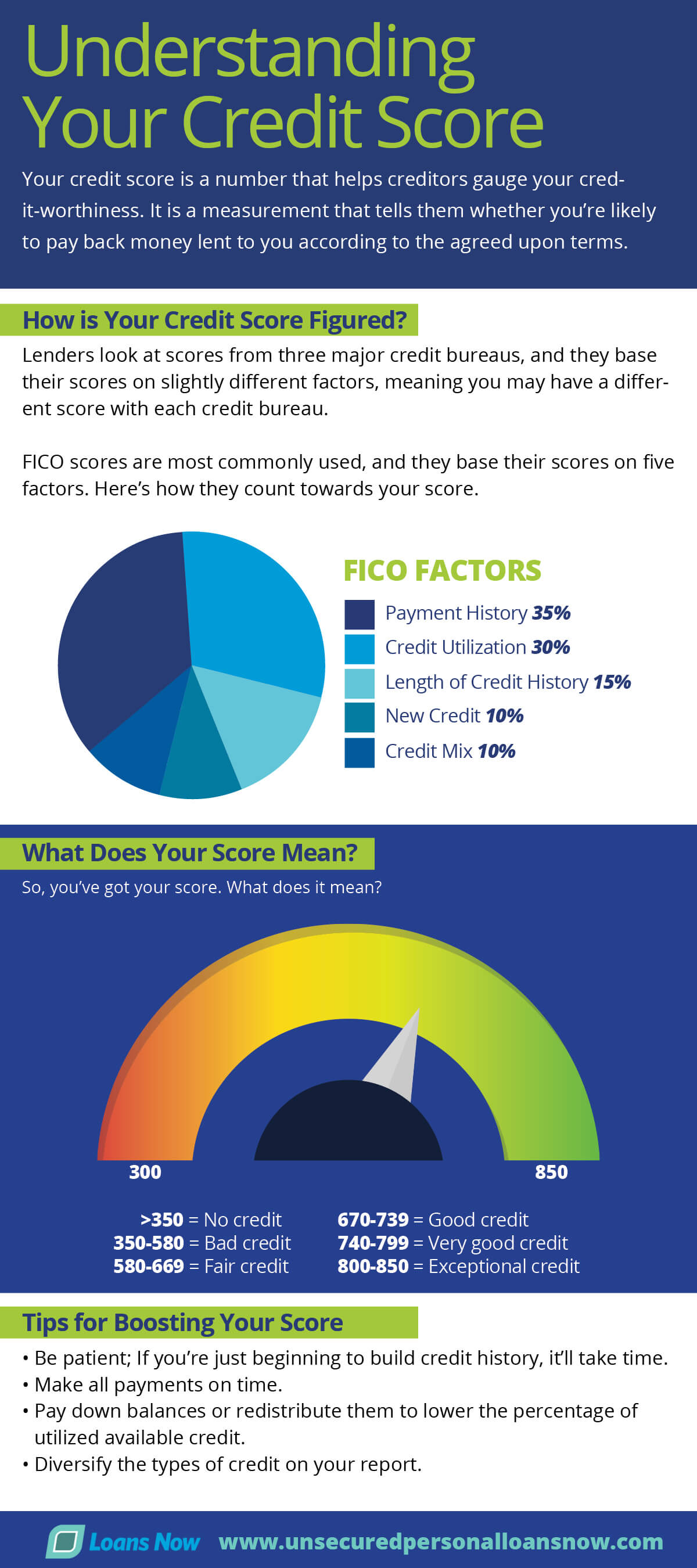

Roofing system funds to own property owners having a good credit score are going to be a no-brainer, given that you might not just be accepted, however you will also be provided a reduced interest than simply individuals which have fair or less than perfect credit scores.

Into drawback, residents who will be still gathering their borrowing and also certain try to do to obtain it to help you good otherwise excellent may become denied or considering highest-interest personal loans. A method surrounding this is to provide guarantee, which could reduce your interest.

Although it is reasonable to help you ask together with your current financial on the the personal loan facts, branch aside and get almost every other banking companies whatever they could possibly simplycashadvance.net borrow money online offer you, while they you are going to go back having some thing way more glamorous.

Family collateral financing

Lenders have to have assures out of those individuals they are doing team which have the currency they mortgage should be recouped, this is the reason they will certainly offer property collateral mortgage to own roof projects. This type of financing is common while they generally carry a low-rate of interest. However, you need to have confident security of your home managed so you can meet the requirements, and that means you have probably owned the house for many years and then have repaid a big amount of the house.

Brand new regards to a home equity mortgage are usually set up to your bank to spend monthly payments more than an expansive months of energy, but the procedure of handling the period will be time ingesting, which is why you really need to start setting which upwards weeks ahead of time. not, immediately following all the data files regarding this type of financing was closed, the lender will send the bucks towards roof builder.

In the event the starting your residence just like the guarantee seems like a dangerous disperse, just remember that , if you can help make your money, the lender cannot take you home, but really that’s the risk a resident takes when securing that it form of loan.

Family equity personal line of credit (HELOC)

In the world talk, a property security credit line is largely regarded by the acronym HELOC. Therefore, how come that it differ from a home guarantee mortgage? The solution is during the cash is distributed for your requirements. A good HELOC allows you to use your domestic as security, nevertheless score a personal line of credit than the a house security loan’s lump sum matter.

Generally speaking, you should have 10 years to draw with this personal line of credit and pay it back since you wade. Getting homeowners that have a roofing enterprise, followed by a good exterior venture, followed closely by substitution screen and you can gutters, the HELOC looks like advisable, as they can play with their line of credit for every single enterprise.

Add Comment

Only active ALBATROSS Racing Club members can post comments