Several Applications that have Great features getting Veterans Staying in Tx

Pros and you will active obligation military authorities enjoys one or two reputable financial support choices for domestic to buy the fresh Texas Vet Program while the Virtual assistant Financing System. When you find yourself both programs bring purchasers better experts and you can savings possibilities, you must contrast both and you can understand and therefore option suits you.

Understanding the difference between a texas Veterinarian mortgage and you can a good Va financing is vital in making an informed choice about purchasing a house. Of rates and you will settlement costs to your limit loan amount and you can occupancy tenure, there are various evaluation facts to consider when selecting a feasible financing program for your house purchase.

So you’re able to make a decision, view the intricate guide by the the experienced elite group for the Tx domestic monetary things. We provide this comprehensive self-help guide to help you select the right mortgage option you to guarantees maximum monetary advantage.

Colorado Vet Financing and you may Va Financing Analysis

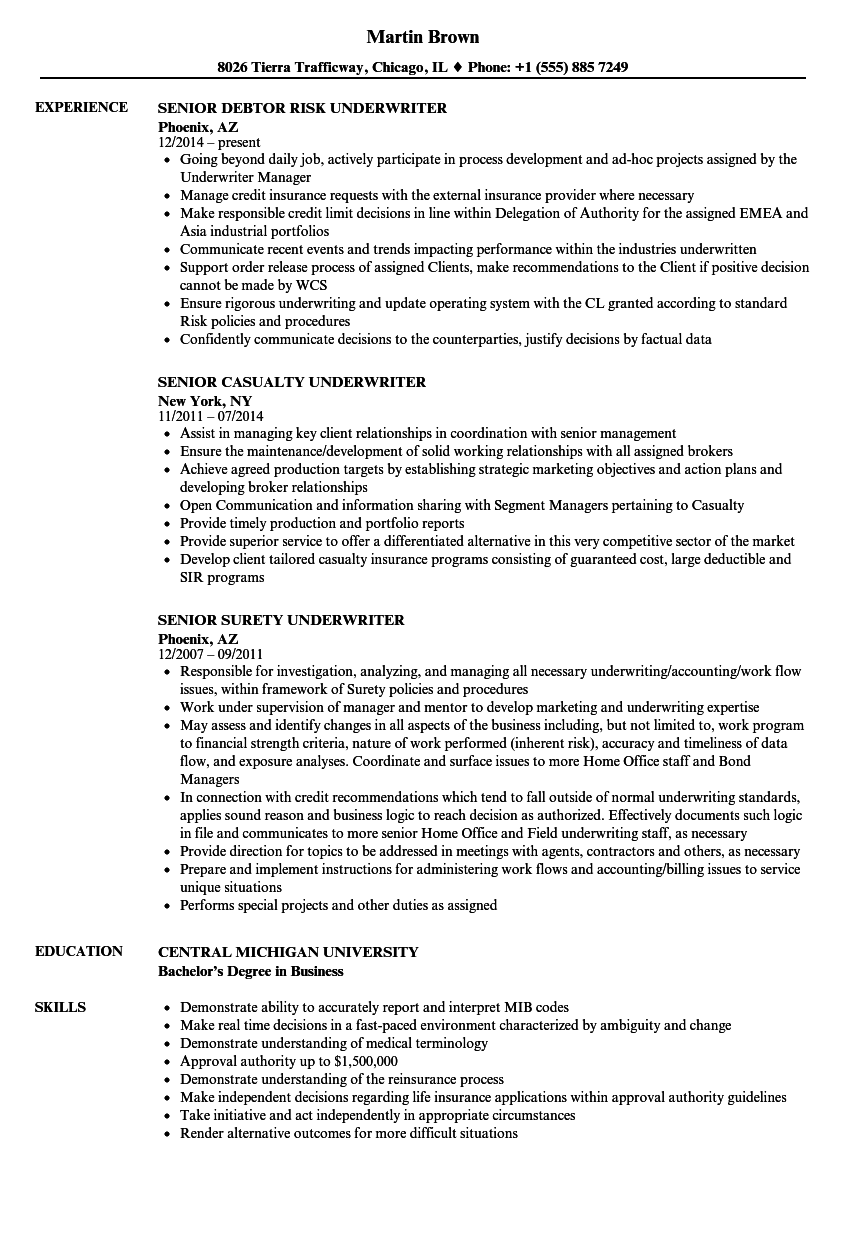

Find out about the fresh new critical points of difference between Colorado Veterinarian loan and you may Va loan from this full chart. It helps you most readily useful comprehend the gurus and you will comforts provided by both financing apps within the Tx before you choose a money selection for your property.

Texas Vet Price versus. Va Mortgage Rate

The difference between a tx Veterinarian financing and you may an effective Va loan is mainly according to interest levels, occupancy, charges, and other vital financing knowledge. Since the pris is dependant on their interest price computation, additional factors that also make the a couple of unlike was fico scores and rate secure conditions. Why don’t we take you step-by-step through new Texas Pros Property Panel versus. Virtual assistant financing info that will help you like your residence financing solution.

- Tx Veterinarian Loan Rates: The eye pricing having Colorado Veterinarian Fund try modified each week, towards the newest prices taking feeling all Friday. As a result the pace you may be available at the start of the fresh few days is the price that implement throughout that few days, bringing specific balances on the speed hunting process.

- Government Va Financing Cost: In contrast, Government Virtual assistant financing rates can to evolve daily according to business conditions. Which fluctuation means that the rate may vary from one time to the next, that may affect the loan pricing over time.

Contrasting Has actually Between Tx Vet Loan and you may Virtual assistant Loan Possess

It investigations graph clearly teaches you the essential difference between a colorado veterinarian mortgage and you can a good Virtual assistant financing and you may illuminates the pros pros found regarding the software. This will help to you select the most possible loan option that match your own homeownership goals which is appropriate for your financial background.

Difference between Colorado Veterinarian Financing and Virtual assistant Loan Closing costs

When comparing Colorado Vet mortgage vs. Virtual assistant mortgage settlement costs, it becomes clear you to each other mortgage apps are supposed to help veterans in their house to order conclusion. Yet not, he’s different costs and costs, truly affecting the overall cost of closure the loan. Check critical factors out of closing cost reviews.

- This may is a-1% origination payment.

- Probably includes a-1% involvement payment.

- Underwriting charges could possibly get pertain.

- Discount products aren’t anticipate.

- Settlement costs consist of a lot more charges eg appraisal, title insurance coverage, survey, and county tape costs.

- Colorado Veterinarian Finance have particular energy savings criteria that at some point effect settlement costs according to the property.

- Generally, dont include an enthusiastic origination percentage in the event the lender fees the latest VA’s 1% flat rate.

Other than these types of differences when considering Colorado veterinarian financing and you can Va mortgage settlement costs, each other programs loan places Hudson is deal with more costs, along with assets fees, prepaid service appeal, and you will homeowner’s insurance coverage. And, the actual settlement costs disagree for the bank, the spot of the home, or other mortgage criteria. To acquire perfect details of the fresh settlement costs of Tx Vet and you may Va loans, talking to an experienced and you may devoted financing administrator is needed.

Add Comment

Only active ALBATROSS Racing Club members can post comments