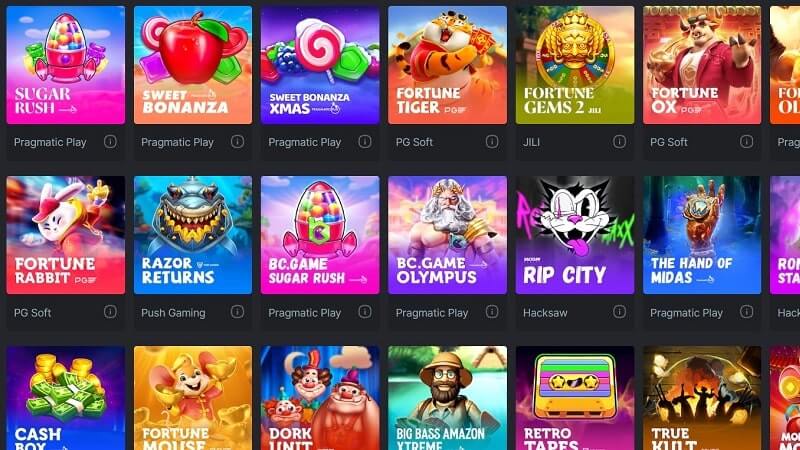

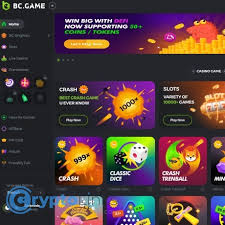

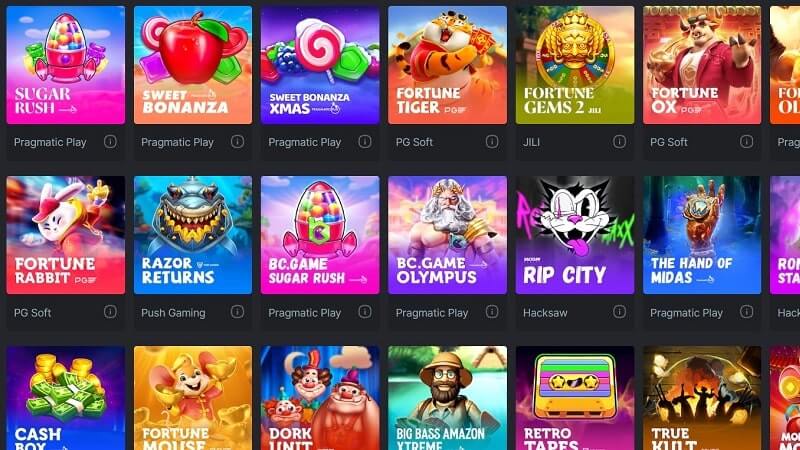

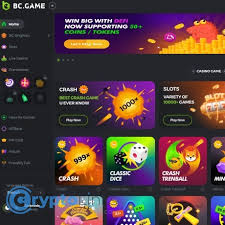

For example, for those who’re also a die-hard NetEnt lover, you need to choose casinos one machine a thorough alternatives of its video game. On the other hand, if you need some variety on the gambling experience, the availability of specialization games for example abrasion cards, keno, otherwise slingo could be the deciding factor. I take on a variety of percentage strategies for withdrawing earnings along with playing cards, e-purses and you will bank transfers. No more take a trip long distances otherwise adhering to rigorous doing work days. Web based casinos offer the freedom playing just in case and no matter where you decide on. (more…) That said, there are gambling enterprises, and that twist a little restrictive limitations to the win and you will detachment amounts. This is why why we evaluate these limitations in our gambling enterprise reviews. (more…) In recent years, online gaming and cryptocurrency gambling have surged in popularity worldwide. Among the platforms gaining traction is BC Game, a popular online casino that allows users to use cryptocurrencies to place bets on various games. If you're interested in BC Game En el corazón de la revolución digital, el mundo de los juegos de azar ha experimentado una transformación significativa en la última década. Con la llegada de las criptomonedas y la tecnología blockchain, plataformas como BC Gam In recent years, online gaming and cryptocurrency gambling have surged in popularity worldwide. Among the platforms gaining traction is BC Game, a popular online casino that allows users to use cryptocurrencies to place bets on various games. If you're interested in BC Game En el corazón de la revolución digital, el mundo de los juegos de azar ha experimentado una transformación significativa en la última década. Con la llegada de las criptomonedas y la tecnología blockchain, plataformas como BC Gam Orale Steroide sind synthetische Abkömmlinge von Testosteron, die in der Regel zur Stärkung der Muskelmasse sowie zur Verbesserung der sportlichen Leistung eingesetzt werden. Diese Medikamente werden häufig von Bodybuildern und Athleten verwendet, um schneller Ergebnisse zu erzielen. Dabei ist es wichtig, die Funktionsweise, die Anwendungsmöglichkeiten und die potenziellen Risiken zu verstehen. Die Website https://clomed-de.com/product-category/orale-steroide/ hilft Ihnen zu verstehen, wie Orale Ste Tamoxifen ist ein selektiver Estrogenrezeptormodulator (SERM), der hauptsächlich zur Behandlung von hormonempfindlichem Brustkrebs eingesetzt wird. Es wirkt, indem es die Wirkung von Estrogen im Brustgewebe blockiert, was tumorfördernde Effekte verringern kann. In der Bodybuilding-Community wird Tamoxifen oft verwendet, um die Nebenwirkungen von anabolen Steroiden zu minimieren und die körpereigene Testosteronproduktion zu unterstützen. Möchten Sie Tamoxifen Bodybuilding kaufen? Dann sehen Sie sich den Preis auf der Website der deutsche Pharma-Plattform an.

Understanding BC Game Legality in Latvia

Understanding BC Game Legality in Latvia