We want to see what they claim regarding the gambling enterprises you are contemplating joining. Do not just look at the nutrients, but see if the brand new local casino pays the members and you may snacks all of them pretty. Casino (Affiliate) Online forums. You really need to see common gambling enterprises, market gambling enterprise online game and you will associate community forums. It is possible to pay attention to first hand out of professionals and you may affiliates from the hence gambling enterprises was managing them well . Local casino Blacklists. Blacklists inform you just wh

All the gambling enterprises is install predicated on within the-depth market and user look, taking into account your business needs and eyes.

Both I am going to twist a few slots in order to citation the full time, and other days I shall discover a great roulette desk otherwise try specific black-jack

FAQ. You will additionally have the ability to located revealing gadgets, intricate associate personas, representative journey charts, or other possibilities based on your company standards.

It�s designed to help make your functions easier and mor

Experience the thrill of premium online casino gaming from the comfort of your home. Our platform offers a vast selection of certified fair games, generous bonuses, and secure banking for a superior entertainment experience.

Understanding the Digital Gaming Landscape

The digital gaming landscape encompasses a vast ecosystem of platforms, genres, and business models, from console and PC titles to mobile and cloud-based streaming services. Understanding this dynamic environment requires analyzing player demographics, monetization

České casino s licenci: Bezpečné a zábavné hraní

Ve světě online hazardních her hraje české casino s licenci klíčovou roli v oblastech jako je bezpečnost a férovost. To umožňuje hrá�

Mostbet com İdman Əhatəsi: Mövcud Liqalar və Turnirlər

Mostbet com saytında idman bahisleri üçün geniş miqyasda liqalar və turnirlər təqdim olunur. İstər futbol, istər basketbol, istər tennisdə və digər populyar idman növlərində Mostbet idman sevənlərə zəngin seçim imkanı yaradır. Bu məqalədə Mostbet com saytında mövcud olan əsas liqalar və turnirlər haqqında ətraflı məlumat təqdim ediləcək. Saytın idman əhatəsi çoxşaxəlidir və müxtəlif kateqoriyalarda bahis etmək istəyənlər üçün əlverişli seçimlər təqdim edir. İst�

Permainan kasino menawarkan sensasi dan kegembiraan yang tak tertandingi, di mana setiap putaran dan setiap kartu bisa membawa kemenangan besar. Rasakan sendiri ketegangan dan hadiah menggiurkan yang menanti di meja permainan ikonik ini.

Jenis-Jenis Taruhan Populer di Indonesia

Di Indonesia, taruhan olahraga telah menjadi fenomena yang dinamis dengan beragam pilihan untuk para penggemar. Sepak bola mendominasi dengan taruhan seperti handicap Asia dan Mix Parlay yang menawarkan keuntungan berlipat. Selain itu, ta

Jelajahi dunia permainan kasino yang mendebarkan, tempat hiburan bertemu dengan peluang menang besar. Rasakan sensasi tak tertandingi dan klaim kemenangan Anda di meja yang paling ikonik.

Permainan kasino menawarkan sensasi dan keseruan yang tak tertandingi, dari mesin slot yang berwarna-warni hingga meja permainan klasik yang menegangkan. Temukan dunia hiburan dewasa yang menghibur dan penhadiah ini, selalu dengan bertanggung jawab.

Jenis-Jenis Taruhan yang Tersedia di Platform Online

Di platform online, ada banyak jenis taruhan yang bisa kamu coba, mulai dari yang klasik sampai yang modern. Kamu bisa pasang taruhan mix parlay yang seru, atau pilih taruhan langsung live betting saat pertandingan

Nouveau site de casino en ligne : Conseils pour jouer responsable

Avec l'émergence de nouveaux sites de casino en ligne, il est essentiel de jouer responsable pour profiter pleinement de cette expérience sans risque excessif. Cet article abordera des conseils pratiques pour s'assurer que votre temps de jeu est à la fois amusant et sécurisé. Que vous soyez novice ou joueur expérimenté, ces conseils vous aideront à maintenir un équilibre sain entre le divertissement et la responsabilité.

Comprendre les risques du jeu en ligne

Avant de vous lancer dans l'univers

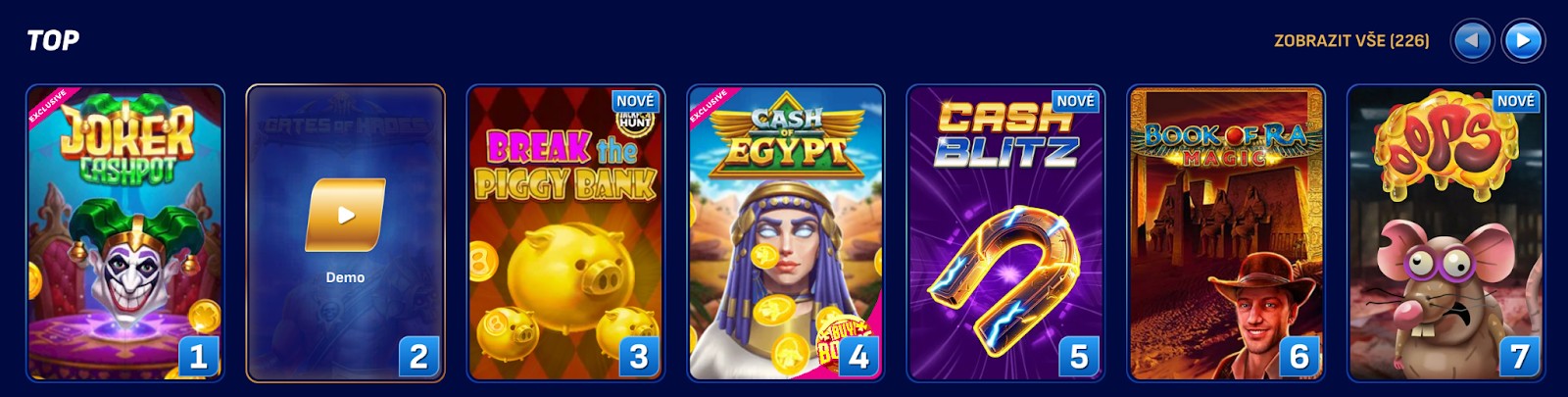

Introduction to Casino Slot Machines

Casino slot machines remain a cornerstone of entertainment across USA casinos, offering thrilling gameplay and substantial rewards. From timeless classics to cutting-edge innovations, these games cater to every preference. Whether you're a seasoned player or new to the scene, understanding the landscape of top slot machines is essential for maximizing enjoyment and potential wins.

Popular Classic Slot Machines

Classic slot machines, such as fruit machines and three-reel models, evoke nostalgia with their simplicity. These games o

Zing Coach AI {Fitness|Health} App Reviews

Zing Coach AI {Fitness|Health} App has garnered {a {mix|combine} of|a {mixture|combination} of} {reviews|critiques|evaluations} from {users|customers} {seeking|looking for|in search of} {a personalized|a customized|a personalised} {workout|exercise} {experience|expertise}. Many {users|customers} {appreciate|respect|recognize} the app's {intelligent|clever} AI {features|options} that tailor {exercise|train} plans {based|based mostly|primarily based} on {individual|particular person} {goals|objectives|targets} and {fitness|health} {le