Prepaid Kreditkarte anonym: So schützen Sie Ihre Sicherheit & Datenschutz

Das Geld wird hierbei auf eine Karte geladen, die wie eine Kreditkarte genutzt werden kann. Digitale Geldbörsen und mobile Geldüberweisungen sind ebenfalls eine Möglichkeit. Hierbei wird das Geld auf ein digitales Konto überwiesen und kann dann an den Empfänger gesendet werden.

Prepaid Codes für Einmalzahlungen

Dabei entfallen lange Banklaufzeiten und das Geld ist direkt verfügbar. Falls du dich fragst, wie du Geld ohne ein Bankkonto versenden kannst, lies unser

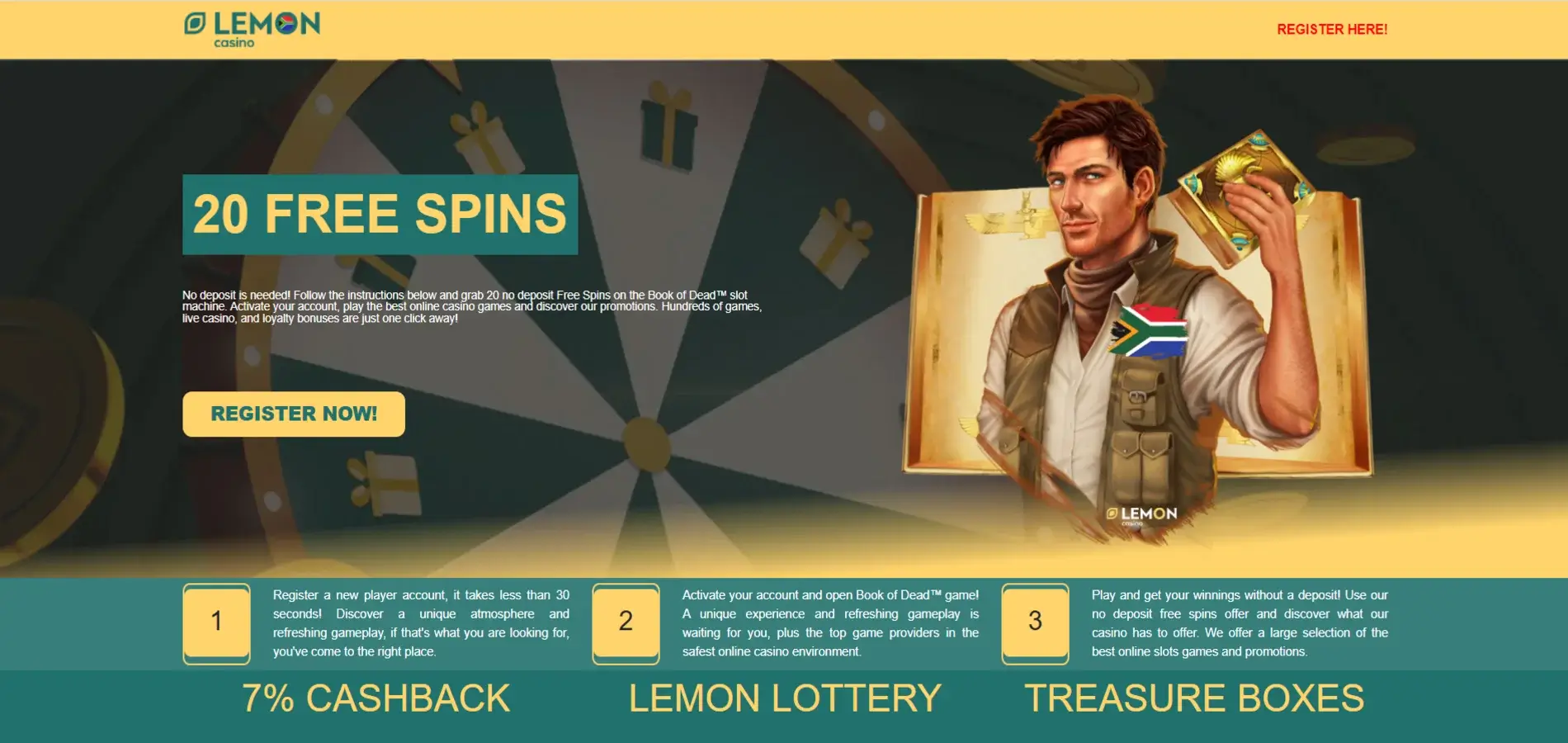

Wenn Sie mit Lemon Spielhaus in die Sphäre des Internet-Spielens einsteigen möchten, ist es essenziell, den Anmeldevorgang zu verstehen. Sie können feststellen, dass die https://lemon-hu.com/de-at/ Befolgung der Altersanforderungen nur die Spitze des Problems ist. Von der Eingabe Ihrer persönlic

Но ее основании создаются различные децентрализованные блокчейн приложения. А, для того чтобы обеспечить дополнительную безопасность, можно использоваться смарт-контракты. Платформа ориентирована на криптоинвесторов, мобильных пользователей и тех, кто ищет безопасные и быстрые платежные решения. Блокчейн TON исключает вм

Content

Deshalb können Diese diese besten Projekte von bekannten Entwicklern finden. Manchmal aufstöbern Sie selbst experimentelle Spiele unter einsatz von dreidim

To claim bonuses at Need For Spin Casino, players must first establish an account live casino Casino NeedForSpIn by entering necessary personal information and a valid email. They should then navigate to the promotions page, where they’ll find various bonus offers. Obtaining a welcome bonus may require inputt

Jagdtipps für Einsteiger: Ihr vollständiger Leitfaden für Jagdstrategien und Sicherheit

Um beim Bingo herausragende Leistungen zu erbringen, ist es unerlässlich, die verschiedenen Muster zu verstehen. Kartenspiele in Casinos folgen seit langem bekannten Mustern — Blackjack, Baccarat und traditionellem Poker. Erfahrene Spieler, insbesondere diejenigen, die Erfahrung mit Texas Hold'em haben, suchen jedoch oft nach neuen Herausforderungen. Hier kommt Short Deck Poker ins Spiel, eine spannende Variante, die die Pokerwelt im Sturm erobert hat. Glücksspiel kann ein aufregend

"posido Casino Κριτική 2025 100% Ως Τα 500 Και Two Hundred Δπ"

Рынок платных интимных услуг — одна из самых спорных и интересных тем в современном обществе. В условиях легализованной проституции мужчины нередко становятся клиентами куртизанок, чтобы удовлетворить свои желания и получать удовольствие без обязательств. Но почему именно проверенные профессионалы в этой области станов

New casino no deposit bonus

Casinos offer free no deposit bonuses as a way to attract new players and stand out in a highly competitive market. By providing these bonuses, casinos give players an incentive to sign up and try their games without any financial commitment MoonWin Casino. This strategy not only helps in building a player base but also allows players to familiarize

Ervaar de sensatie van onmiddellijke bevrediging met casino's met onmiddellijke uitbetaling die snelle geldoverdrachten garanderen via tikitakacasino.be veilige en snelle uitbetalingskanalen. In een tijdperk waarin het slagveld van online casino's heviger is dan ooit, hebben talloze domeinen hun spel verbeterd en bieden ze razendsnelle of zelfs on-the-spot geldtransacties. Ga naar de officiële website van Casinovlaanderen.com voor een uitgebreide Casinovlaanderen.com recensie of om de Casinovlaanderen.com app te downloaden. Bij Ladbrokes Casino, een