No offers are essential. The lending company totally cash the acquisition of your own brand new home. All you have to love is your monthly mortgage repayments. Musical high, doesn’t it?

These financing have the potential to enable it to be consumers in order to secure an excellent property you to definitely most other finance companies won’t thought offering them that loan to your. And in Cayman’s latest real estate market, frequently it’s the only path some one access it the fresh new possessions steps.

Added Bills

For the reason that the speed where the bank tend to charges your focus is much higher. Just what you find yourself paying the financial altogether appeal (what kind of cash paid down on top of the purchase price loan places Boaz across the name of one’s financing) is significantly greater.

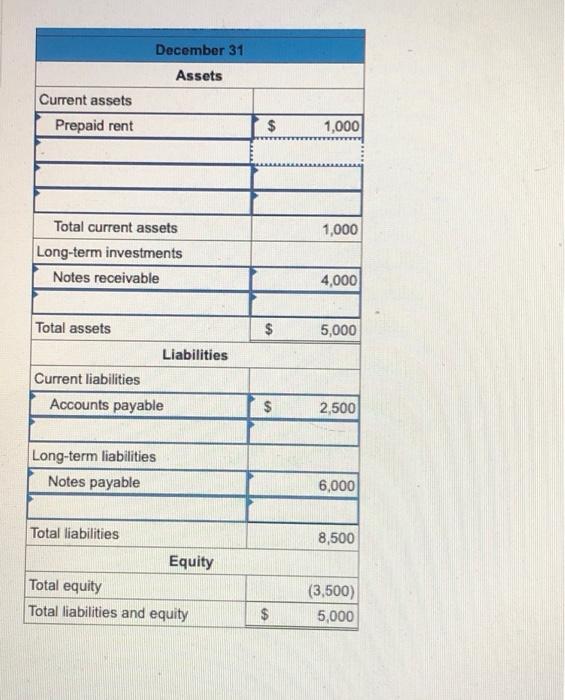

Lower than are a side of the side research of 100% investment and a standard loan. This situation is dependent on previous cost to finance a keen Isabela Properties belongings package, indexed in the CI$30,700 regarding Cayman Brac.

The lending company was and in case greater risk whenever offering 100% financing. Consequently, they charge a higher interest to ensure they make the money back. Therefore although you don’t need to promote money initial, you in the course of time spend far more on property.

The pace while the full interest over the mortgage label are just one or two products you ought to think when you compare capital choices. Having standard information regarding mortgage loans, I encourage that read my earlier in the day blog: Mortgages in the Cayman.

Additional Some time Fret

In my experience, this new associations offering 100% resource mortgages become delaying assets conversion process. Just how long between whether your Bring is accepted so you can brand new Closing day would be a lot longer and frequently significantly more tiring – for everyone events with it.

If it is not a community Classification A financial on Cayman Countries, even “pre-approvals” dont always make sure your that loan. Your loan application must cross multiple desks, and perhaps, come off-area prior to they can prove your loan.

Unappealing Offers to Suppliers

Suppliers would-be comparing the Bring to order to anybody else. Of course, speed are the greatest determining factor, although amount of criteria, new schedule to shut, and type of money is determine whether a provider welcomes an offer.

The amount of time and fret that comes with 100% financial support mortgage loans you’ll dissuade suppliers out of taking your own Promote. In short, the lending company you select is also place you getting left behind.

Since the a purchaser, this will end up being discriminatory. Why must owner care and attention where you are having your funds out-of? Place on your own from the Seller’s footwear. If they can conduct the fresh new revenue of their assets within a couple months versus five weeks and get away from unanticipated things, delays, and you may concerns, after that however, they are going to stick to the extremely uncomplicated Give. They want to mark their property off the market whilst you function with your standards time which might be wasted in the event your financial is not approved.

Put However Necessary

A deposit, otherwise what specific will get telephone call earnest money, is when people show manufacturers they’re not merely wasting time. It is like a protection put on the sale by itself – whether your sales experiences, you earn your finances straight back if you find yourself recognized getting 100% investment. But not, you still need to have the fund on your own account, ready to put down after you create your Promote into the supplier. This type of finance try following kept in escrow (yet another carrying membership) before possessions exchange is complete. Regrettably, that isn’t unusual, especially for first-time people, lured by 100% investment regarding bank, to overlook looking for financing with the deposit.

Add Comment

Only active ALBATROSS Racing Club members can post comments