Juan PHILLIPS, Plaintiff, v. Couples Home Guarantee Properties, INC.; Citigroup, Inc.; CitiFinancial Credit Team; Couples Very first Financing Organization; and Lovers Business of North america, Defendants.

*841 *842 Cathleen Mbs, Daniel An effective. Edelman, James O. Latturner, Amy A. Breyer, Danita Ivory, Edelman, Combs & Latturner, Chicago, IL, to possess plaintiff.

Plaintiff Juan Phillips submitted a class step ailment alleging abuses away from the fact for the Lending Act, fifteen U.S.C. 1601 ainsi que seq., concerning the defendants’ handling of residential financial transactions. This situation is actually through to the Courtroom to the defendants’ motion in order to compel arbitration and start to become such procedures centered on a keen arbitration agreement executed by Phillips and you will accused Associates Family Security, and you may defendants’ action to loans in Cattle Creek write off the category states pursuant so you can Provided.R.Civ.P. 23(d) (4) and you may 12(b) (6). Toward causes detailed lower than, defendants’ actions so you can compel arbitration are denied, and you may ruling on defendants’ activity so you’re able to discount is actually deferred.

In the , Phillips obtained a domestic mortgage loan regarding number of $72,900 of accused Partners Home Guarantee to finance home improvements and you can pay-off her existing user costs. Couples Domestic Guarantee also provides lending products and you will attributes including household equity fund, unsecured loans, vehicle money, and you can retail sales resource to help you customers, and it focuses primarily on providing borrowing from the bank towards “subprime” field, having its people that happen to be reported to be poor credit dangers. Phillips’ loan was initially put up *843 because of the a mortgage broker, Ficus Economic, that’s not entitled about problem.

Included in their particular financing transaction, Phillips obtained and/otherwise signed a basic mode mortgage broker arrangement, financing contract, a speed protection driver, a believe deed, a great TILA revelation declaration, a HUD-step one settlement report, and you may an alerts regarding their right to terminate

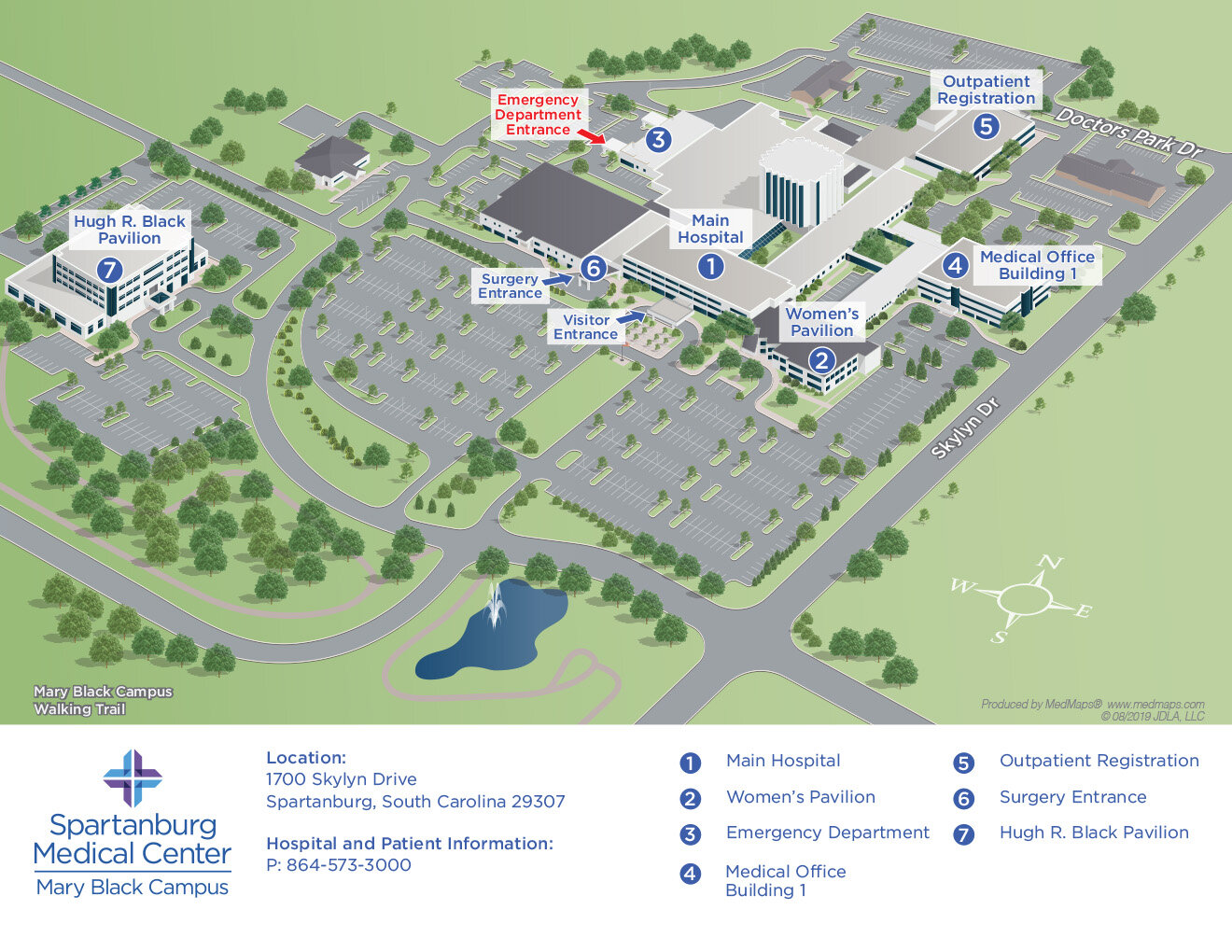

+08-07-2019.jpg)

Toward , in connection with the borrowed funds purchase, Phillips and you can Associates Family Collateral in addition to inserted into the a created arbitration arrangement. On top of other things, the new agreement contains a part named “Conflicts Secure” giving your functions agree to arbitrate “all of the claims and you can issues anywhere between you [Phillips] and you can you [Associates House Guarantee],” along with “instead restrict, the says and you will problems occurring from, regarding the, or in accordance with” the mortgage. See Arbitration Arrangement, Plaintiff’s Objection so you can Arbitration, Display D. Brand new arrangement next provides one arbitration might be conducted from Western Arbitration Connection (“AAA”), pursuant to their then-most recent “Industrial Arbitration Statutes.”

Can cost you Out-of ARBITRATION: For folks who initiate arbitration, you agree to spend the money for initially filing percentage and you may needed deposit required by brand new Western Arbitration Organization. Whenever we begin arbitration, we will pay the filing fee and you may necessary put. If you think you are economically not able to shell out instance costs, your erican Arbitration Connection to help you postponed otherwise clean out such as charges, pursuant on the Industrial Arbitration Laws and regulations. If the American Arbitration Connection will not postponed otherwise get rid of such as for instance costs which means you have enough money them, we are going to, up on the composed consult, afford the costs, at the mercy of people later allocation of the charges and you will costs between both you and you by arbitrator. There may be other can cost you during the arbitration, such as attorney’s fees, expenses out-of happen to be the fresh arbitration, together with will cost you of your own arbitration hearings. The economic Arbitration Legislation dictate that will pay those costs.

To your , Phillips blogged a page to Partners Home Collateral purporting so you can rescind their particular loan arrangement pursuant so you can TILA

“It is past peradventure your Government Arbitration Act symbolizes a good federal plan and only arbitration.” Nice Hopes and dreams Endless, Inc. v. Dial-A-Mattress Global, Ltd., step 1 F.3d 639, 641 (7th Cir. 1993) (citing Moses H. Cone Art gallery Healthcare v. Mercury Construction, 460 You.S. 1, 103 S. Ct. 927, 74 L. Ed. 2d 765 (1983)). The new team face-to-face arbitration bears the burden off demonstrating your claims under consideration commonly susceptible to arbitration. Environmentally friendly Forest Monetary Corp. v. Randolph, 531 You.S. 79, 91-92, 121 S. Ct. 513, 148 L. Ed. 2d 373 (2000). Phillips makes five objections opposed to arbitration: (1) she rescinded the whole loan transaction (including the arbitration contract), and so the arbitration agreement try not to now become enforced; (2) brand new arbitration agreement is actually a keen unenforceable waiver off their unique substantive legal rights lower than TILA because does not ensure their own a honor off attorneys’ costs and you will legal actions costs when the she’s profitable in arbitration; (3) this new arbitral forum is actually prohibitively costly; (4) the latest American Arbitration Connection try biased in favor of the latest defendants; *844 and you will (5) the brand new arbitration contract was caused by fraud on the incentive. Merely Phillips’ disagreement regarding the expenses of your arbitral discussion board is enough to defeat defendants’ motion to help you compel, and on that it base i refuse the fresh motion. We’ll manage each of Phillips’ arguments, addressing the purchase price argument past.

Add Comment

Only active ALBATROSS Racing Club members can post comments