Spot trading on PrimeXBT: A Comprehensive Guide

Spot trading is one of the most straightforward and accessible methods of trading in financial markets. On platforms like PrimeXBT, trading is made efficient, allowing traders to buy or sell assets instantly. This article delves into the details of Spot trading on PrimeXBT Giao dịch Spot trên PrimeXBT, covering the fundamentals, advantages, and key strategies for success.

Understanding Spot Trading

Spot trading refers to the purchase or sale of an asset for immediate delivery. It is different from derivatives trading (like futures) where contracts are bought and sold for delivery at a later date. In spot trading, the transaction occurs in real-time, and assets are transferred on the spot, which means that buyers and sellers must have those assets on hand.

Why Choose PrimeXBT for Spot Trading?

PrimeXBT is a versatile trading platform that offers a variety of features aimed at enhancing the trader’s experience. Here are a few reasons why spot trading on PrimeXBT is appealing:

- User-Friendly Interface: PrimeXBT’s platform is designed with the user in mind, making it easy for both beginners and seasoned traders to navigate the various trading options.

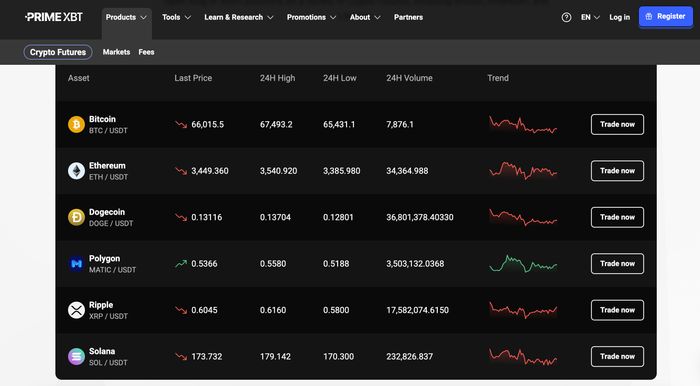

- Diverse Asset Selection: The platform allows users to trade a wide range of cryptocurrencies, traditional assets, and forex pairs.

- Advanced Trading Tools: Traders have access to a variety of analytics tools, market indicators, and charts to enhance their trading strategies.

- High Liquidity: High trading volumes ensure that transactions can be executed quickly, reducing slippage and enhancing trading efficiency.

- Security Features: PrimeXBT takes security seriously, employing stringent measures to protect user funds and personal information.

Spot Trading Strategies

Effective trading strategies can significantly boost your success rate in spot trading. Here are some popular tactics:

1. Trend Following

This strategy involves analyzing market trends and making trades in the direction of these trends. Traders typically use technical indicators to determine whether a market is in an upward or downward trend and make their moves accordingly.

2. Range Trading

Range trading is based on the assumption that prices will bounce between established support and resistance levels. Traders identify these levels on charts and make trades whenever the asset price approaches these points, buying near support and selling near resistance.

3. Breakout Trading

Breakout trading involves entering a position once the price breaks through a predefined support or resistance level. This strategy can capitalize on sudden price movements that often follow breakouts.

Managing Risks in Spot Trading

While spot trading can yield substantial profits, it is also fraught with risks. Here are several risk management techniques to consider:

1. Use Stop Losses

Setting stop-loss orders can minimize losses by automatically closing a position at a predetermined price level. This tool allows traders to manage their risk effectively.

2. Diversify Your Portfolio

Diversification reduces risk by spreading investments across various assets instead of concentrating in one. This way, poor performance in one asset may be offset by gains in another.

3. Limiting Position Sizes

Only risk a small percentage of your trading capital on any single trade. This approach helps preserve capital over the long term and enables you to continue trading through market fluctuations.

Conclusion

Spot trading on PrimeXBT presents an excellent opportunity for traders to engage in the cryptocurrency market with ease and efficiency. Whether you are a newcomer or an experienced trader, understanding the fundamentals of spot trading, employing effective strategies, and managing risks can significantly enhance your trading experience. By leveraging PrimeXBT’s robust platform, you are well-equipped to navigate the complexities of spot trading and strive for trading success.

Add Comment

Only active ALBATROSS Racing Club members can post comments