Really worth Make Residential property is not an effective cookie-cutter homebuilder. Indeed, i strive become other. We specialize in building individualized belongings on the end in NC , working with you from the start using closure. And we also is hook you toward most readily useful lenders during the a, too!

Choosing the right financial for your situation are a critical area of the homebuilding procedure. We are going to assist you thanks to every step in this process, playing with our very own usage of brand new structure mortgage masters to have the best capital plan you’ll to create your fantasy home.

How to Qualify for home financing within the North carolina

New york even offers various apps that provides information, financial assistance, or other resources. An element of the the best thing accomplish is actually: 1.) know what you can afford, and you may 2.) know very well what kind of money you could potentially be eligible for.

With respect to knowing how much domestic you can afford, just remember that , and purchasing the house, you need to have currency arranged to have repair & solutions, resources, and you may problems. And, loan providers favor an obligations-to-money proportion below 42%, so you need to make sure you enjoys as little debt to.

There are various regarding ways to loans a home from inside the NC, and FHA financing, conventional loans, and you can features. (The brand new North carolina Housing Financing Department features helped thousands of North Carolinians in the buying residential property that have a variety of financial support options one generate to find a special domestic sensible!)

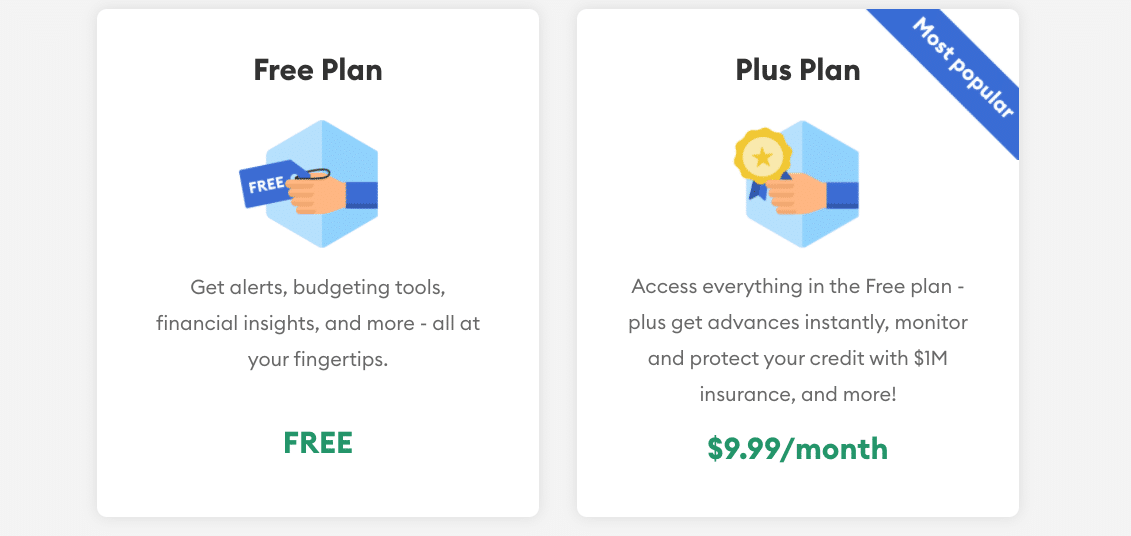

Prior to you do whatever else, it is vital to know in which the borrowing from the bank really stands. Don’t know exactly what your credit history are? Look at the credit history 100% free having Experian. In case your credit score are 620 or higher, you should have a spin from the taking recognized getting a traditional mortgage.

FHA finance are ideal for anyone and families which have reduced in order to reasonable income and less-than-finest fico scores. He’s supported by the new Government Construction Administration (FHA), and may also make it easier to be eligible for a home in the event you not fulfill almost every other requirements.

Antique finance (fixed-price, adjustable-speed, conforming, non-conforming) is money which are not supported by an authorities company. Antique mortgages always have to meet downpayment and you may income standards set because of the Federal national mortgage association and you may Freddie Mac computer, and adhere to mortgage limitations place from the Government Homes Fund Administration (FHFA).

To own assessment: The brand new advance payment into an enthusiastic FHA mortgage try significantly less than a normal financing, constantly no more than step 3.5 %. When you find yourself a conventional mortgage have a tendency to need a rating from 620 or above, with a keen FHA loan, you only need a score with a minimum of 580 so you’re able to be considered. In the event your get try anywhere between 500 and 579, you may still be capable of getting a keen FHA financing in the event that you put 10% down.

Government-backed money (FHA, Va, USDA) are helpful if you don’t have great borrowing or a big down-payment. But if you has good credit or can be place more cash down, a normal loan is likely a far greater alternatives. (The greater amount best parent plus loan of money you place off, the lower your mortgage payment will be!) Contrast the many possibilities in addition to their advantages & cons to get the proper loan to you personally.

Is actually Money a unique Construction Home Distinctive from a great Used Family?

In manners, money a different structure house is similar to bringing a mortgage to get a selling house. But there are several differences. Eg, builders of new structure residential property (such as for instance Worth Generate Land!) may offer resource packages, sometimes truly by way of our own mortgage part otherwise a reliable regional financial .

Simultaneously, you can find book money one to affect the latest residential property but not to resales, including bridge money and the brand new-framework money. Talking about used to loans the acquisition and construction out-of a good new home until the business of the newest domestic.

When choosing a loan provider, you want someone who understands and can show you from the the structure processes, leave you mortgage choices, that assist you select one that serves debt demands. Like, they’re able to make it easier to find out if you need a property mortgage.

Framework fund finance the building of the house. While building a totally custom-built home , you will need a housing mortgage to purchase cost of the brand new information and work to create our home one which just invade they. They are quick-label finance, and so they are located in additional distinctions, for example Construction-Just otherwise Build-to-Long lasting. A talented lender can help you determine how to manage a home inside NC.

How to Financing A house inside the NC

With regards to investment a property during the NC, the greater number of experienced and you may waiting you are, quicker and simpler it would be. Gather your ideas beforehand, know your credit rating, brush abreast of various financing alternatives, and choose ideal lender for the disease. Telephone call (919) 300-4923 or e mail us more resources for your money choice which have Well worth Build Belongings.

Add Comment

Only active ALBATROSS Racing Club members can post comments