The fresh new pre-approval requires a credit score feedback. The lender demands a credit file out of a national borrowing from the bank bureau (Experian, Transunion, or Equifax). It difficult inquiry reduces your credit score because of the a number of affairs. When the zero personal debt is thought, brand new inquiry is removed out of your credit history just after a couple of years.

Pre-acceptance emails are valid for as much as ninety days. It will require about 10 business days so you can processes the fresh inquiry, so it makes sense to attend if you don’t are quite ready to create a deal. For people who apply too-soon and do not pick property, brand new recognition will get expire and you may need recite the new procedure.

QuickClose On the internet Pre-Approval Application Performance the house To find Techniques

The home to get process was stressful for first-time and recite people. A great pre-recognition have a tendency to provides a plus more than most other buyers versus an acceptance page. It informs the vendor your give holds true and you may conditionally recognized of the a trusted lending company. Investment Bank removes the latest anxiety the help of its easy-to-fool around with QuickClose pre-approval online app. In some brief tips, a lender manager commonly comment your credit report, monetary statements and offer an effective conditional mortgage promote. Because the pick and product sales try approved, the fresh underwriting procedure tend to be sure the value of the house and you will re-check your financial situation. The mortgage relationship is just one of the latest steps before closing the real house business.

Get Home loan Pre-Approval On the web

Our home to shop for procedure is actually aggressive and you will crazy. Certified consumers normally proceed to leading of your own pack by the getting home loan pre-approval online. The process is prompt and you can easy, helping you safe your perfect 2nd home. Don’t hold off. Implement now using our very own on the web app.

On line Financial Pre-Recognition Techniques

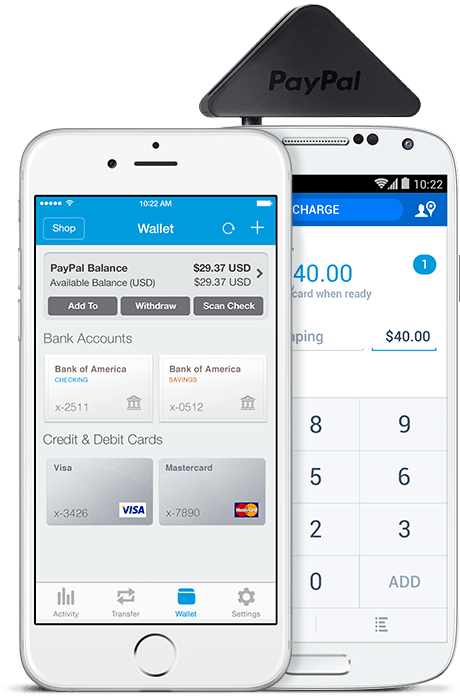

The administrative centre Lender Financial QuickClose processes can help you make an application for home financing pre-approval on the web. Access the web based setting from any pc. Bring your own and you can financial pointers, after that publish their support data. It is a quick and easy techniques. Our very own on line process suits the loan options to your financial budget.

Speak to your Mortgage Maker

Even though the on line pre-recognition financial process was automatic, you’ve still got the option to talk to the home loan creator. You might query questions concerning your financial alternatives otherwise home loan pre-approval on the web processes.

Brief Underwriter Approval

Once your software is finished and records uploaded, you are going to discovered an instant underwriter acceptance, and then located your own pre-acceptance letter. Your upcoming action will be to call your own real estate professional and you will find your brand new home. The pre-recognition page are an excellent conditional provide out-of Money Financial to incorporate a mortgage in line with the underwriter’s remark.

Don’t Mistake Pre-Certified which have an excellent Pre-Approved Page

A beneficial pre-recognized home loan try off a top standard than a great pre-certification page. Brand new pre-recognition procedure reviews debt status and support documents. A keen underwrite analysis the qualifications and you can risks to provide you with the latest pre-recognized mortgage on the web letter. Pre-official certification derive from standard advice and do not are underwriting. my review here When you are putting in a bid to have a home, the fresh pre-acceptance would be felt ahead of an effective pre-qualification page.

What types of Mortgage loans Can you Get On the web

You could potentially sign up for of many mortgages on the on line mortgage pre-approval processes. Mortgages can be found in a good amount of types. Discover 10, 15, and 31-year fixed-rate mortgages. There are even changeable-rate mortgage loans. This type of mortgages transform according to the current rates. They’re able to raise whenever pricing try rising and get rid of whenever cost refuse. Often you can protect variable-speed mortgage loans just after five otherwise seven decades. Speaking of good mortgages to make use of when rates of interest is losing. Their Financial support Bank financial originator will help you see the choices before-going from the online mortgage pre-approval software.

Add Comment

Only active ALBATROSS Racing Club members can post comments